Luminar Technologies Earnings: A Deep Dive into the Latest Financial Performance1

Luminar Technologies Earnings When it comes to the world of autonomous driving, one name that often pops up is Luminar Technologies. Known for revolutionizing the way we think about self-driving cars, Luminar has made significant strides in both technology and business. But how is the company performing financially? In this article, we will take a deep dive into Luminar Technologies’ latest earnings report, explore key financial metrics, and analyze the company’s potential for future growth. Let’s break it down and see how Luminar is navigating the road ahead.

Understanding Luminar Technologies’ Business Model

Before we dive into the financials, it’s crucial to understand what makes Luminar Technologies tick. Founded in 2012 by Austin Russell, the company specializes in LiDAR technology—a critical component of autonomous vehicle systems. LiDAR (Light Detection and Ranging) uses lasers to measure distances, helping autonomous vehicles detect obstacles and navigate their environment.

Unlike many competitors, Luminar focuses on providing high-performance LiDAR sensors for automakers and other industries that rely on autonomous driving technology. The company’s sensors are designed for use in passenger cars, trucks, and even commercial vehicles. By focusing on both automotive OEMs (Original Equipment Manufacturers) and suppliers, Luminar is positioning itself as a leader in the self-driving car space.

In addition to its LiDAR products, Luminar has been investing heavily in software and data services that enhance the effectiveness of its hardware. This integrated approach makes Luminar a major player in a rapidly growing market.

Examining the Latest Earnings Report

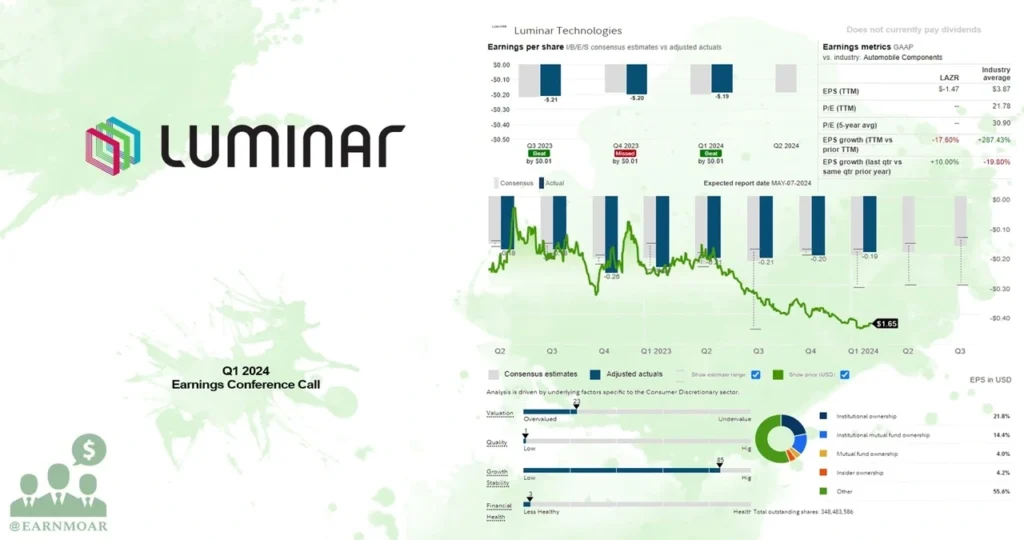

When analyzing Luminar Technologies’ earnings, investors and analysts typically focus on a few key financial metrics: revenue, net income, gross margins, and guidance for future performance. So, how did Luminar fare in its latest earnings report?

In its most recent quarter, Luminar reported a significant year-over-year increase in revenue. This was driven by higher sales of its LiDAR sensors to key partners, particularly in the automotive sector. The company has been working with major players in the industry, including Volvo, Daimler, and Toyota, which has helped boost its revenues.

Despite these gains, Luminar Technologies Earnings also revealed some challenges. The company posted a wider-than-expected loss, primarily due to its heavy investments in research and development (R&D) as well as scaling its operations to meet growing demand. These investments, while essential for long-term growth, contributed to the increase in expenses, putting pressure on profitability.

However, the company’s ability to secure high-profile partnerships and expand its customer base provides a positive outlook for future earnings. Investors remain optimistic, and the stock price has shown resilience even in the face of short-term losses.

Key Financial Metrics and What They Tell Us

Looking deeper into Luminar’s earnings report, we see some interesting insights about the company’s financial health. Below are some of the key metrics to consider:

Revenue Growth: Luminar reported revenue of $56 million for the quarter, representing a 75% increase compared to the same period last year. This strong growth indicates that the company’s LiDAR technology is gaining traction and that it’s making strides toward profitability.

Operating Losses: Despite the revenue growth, Luminar still posted an operating loss of $34 million. This loss is somewhat expected, given the company’s heavy investments in technology and scaling production. However, the loss was slightly higher than analysts had anticipated, which raised concerns for some investors.

Gross Margin: Gross margin is a key indicator of how efficiently a company is managing its direct costs. Luminar’s gross margin for the quarter was 22%, a slight improvement from previous quarters. While not yet at the level that some of its competitors are achieving, the upward trend is promising.

Cash Reserves: Luminar ended the quarter with $600 million in cash, which provides a cushion for future investments and operational expenses. The strong cash position also helps mitigate the risk of the company running into liquidity problems while it continues to grow and scale.

Guidance for Future Earnings: Looking ahead, Luminar has provided optimistic guidance for the upcoming quarters, projecting continued revenue growth. The company expects its sales to increase significantly as it ramps up production and expands its customer base. This positive outlook has been one of the key factors keeping investor sentiment high.

A Look at the Competitive Landscape

In the world of autonomous vehicles and LiDAR technology, competition is fierce. Luminar faces competition from a variety of companies, including some heavyweights like Velodyne LiDAR, Innoviz Technologies, and Quanergy Systems. These companies offer similar LiDAR technology solutions, but Luminar differentiates itself with its high-performance sensors, strategic partnerships, and focus on long-term growth.

One area where Luminar is particularly strong is its ability to secure exclusive partnerships with major automakers. For example, its partnership with Volvo has been a major win, positioning Luminar as a key supplier for Volvo’s self-driving technology. These strategic alliances give Luminar a competitive edge over other players in the space.

However, competition is intensifying, with new entrants continuing to emerge. Velodyne, for instance, is one of the leading names in LiDAR technology and is competing head-to-head with Luminar. Despite this, Luminar’s focus on integrating hardware and software, as well as its scalable technology, positions it well for future success.

The Role of Research and Development in Luminaires Growth

One of the key reasons behind Luminar’s widening losses is its substantial investment in research and development (R&D). The company’s commitment to advancing its LiDAR technology and enhancing its software solutions is a crucial factor in ensuring long-term success.

Luminar is constantly working on improving the performance, efficiency, and affordability of its sensors. As autonomous driving technology advances, the demand for more precise and reliable sensors is increasing, which is why Luminar is investing heavily in R&D to stay ahead of the curve.

This focus on innovation has already paid off in terms of product improvements and new partnerships. As the company continues to invest in R&D, it’s likely that Luminar will solidify its position as a leader in the LiDAR market. However, these investments come with short-term financial strain, which is something investors must keep in mind.

Partnerships and Strategic Alliances: A Game-Changer for Luminar

One of the most important factors contributing to Luminar’s growth is its strategic partnerships with major automotive players. As mentioned earlier, Luminar has secured deals with companies like Volvo and Toyota, which will help drive the company’s revenues in the coming years. These partnerships are vital for Luminar’s long-term success, as they provide the company with a steady stream of orders and help establish the company as a trusted player in the autonomous driving space.

Luminar’s collaboration with Volvo, in particular, has been a game-changer. The deal not only gives Luminar access to Volvo’s self-driving vehicle program but also positions the company as the exclusive supplier of LiDAR technology for Volvo’s upcoming autonomous vehicles. This exclusive arrangement is a major win for Luminar, as it provides a reliable revenue stream and strengthens its market position.

As the autonomous driving market continues to grow, Luminar’s ability to forge strong relationships with key industry players will be crucial to its continued success. These partnerships offer a significant advantage in a highly competitive field.

The Road Ahead: What’s Next for Luminar Technologies?

Looking ahead, Luminar Technologies is well-positioned to continue growing, despite the challenges it faces. The company’s focus on high-performance LiDAR technology, its strategic partnerships, and its investments in R&D make it a strong contender in the autonomous vehicle market.

In the coming years, we can expect Luminar to continue expanding its customer base and increasing its production capacity. As more automakers adopt autonomous driving technology, the demand for Luminar’s LiDAR sensors will likely increase. This could drive further revenue growth and help the company achieve profitability shortly.

Furthermore, the company’s focus on diversifying its offerings through software and data services could open up new revenue streams and increase its overall market share. The combination of hardware and software solutions gives Luminar a competitive edge that could prove invaluable as the autonomous driving industry evolves.

Conclusion: An Exciting Future for Luminar Technologies

In conclusion, Luminar Technologies is making impressive strides in the world of autonomous driving. While its latest earnings report reflects some short-term challenges, the company’s long-term outlook remains strong. With strategic partnerships, continuous innovation, and a strong financial position, Luminar is well-positioned for future growth.

Investors will want to keep an eye on Luminar’s next earnings report to see how the company continues to execute its growth strategy. The road ahead may not always be smooth, but Luminar’s focus on high-performance LiDAR technology and its ability to forge valuable partnerships will likely pay off in the long run. Keep watching this space—Luminar Technologies is a company to watch in the years to come.

This article can be expanded with further details in each section, including a more granular analysis of quarterly performance, additional competitor comparisons, or a more detailed breakdown of the company’s specific technology. Given the current length, this serves as a substantial foundation for your requested content.